In an inflationary market, investors need to consider more than just the return on their investment. They should also look at the cost of their investments and how well they can protect themselves from inflation.

If you ask an investment guy “what stocks should I buy if I am worried about inflation” you have probably never gotten the answer you wanted. Normally people like me are much more worried about a person’s risk tolerance or time frame. I am normally helping people figure out how they would invest for the next 30 to 50 years. What is inflation going to be over the next 30 to 50 years? I have no idea. If anyone tells you otherwise…they are trying to sell you something.

Investors of any sort should have a well-rounded portfolio that invests in large companies and small companies, companies based here in the United States as well as internationally. Those companies should be from all sorts of industries…some of your portfolio should be growth oriented while much of your portfolio can also be put into value stocks. None of this should change based on what you think is coming short term. However, it is common to weigh certain areas based on market conditions.

So, if you really want to know my opinion of what may do well in a high inflationary environment…here you go…

I normally suggest that investors use independent investment managers so that they can select virtually any fund or investment that best suits them. Vanguard Funds may have an excellent ETF that tracks the S&P, charges low costs and is super tax efficient. A company like Blackrock may have the most efficient dividend producing large cap index.

TIPS

I am attaching a chart to this story with the performance of the Vanguard Inflation Protected Securities Fund VIPSX over the past year. I am also going to tell you that Vanguard is historically one of the best fund companies ever, but even Vanguard has a tough time protecting money during a high inflationary period…even if invested in a fund that is specifically designed to protect against inflation! It is my thought that a well-diversified and laddered bond portfolio is a better idea than throwing your money in TIPS.

Rather than looking at TIPS, I have tended to recommend that investors decrease the average yield on their bond portfolio. If you are loaning money out for less time, the value of that loan is less impacted by any change in interest rates. It will then become important to extend the maturity of your bond portfolio once rates “normalize.” Whatever that means.

Gold

Gold has historically been an excellent way to hedge against inflation because gold prices have tended to rise as inflation rises. That being said it is difficult to buy gold. It is more difficult to sell gold at a competitive rate.

We have tended to shy away from suggesting gold ETF funds as an inflation hedge in 2022. I certainly have suggested allocations to gold related indexes in the past, but gold prices do not seem to be reacting in the same historical fashion as inflation has peaked up…so it does not appear that gold will play its normal role this time around. Other precious metals have become more precious and may be eating into gold’s traditional role during inflationary times.

Crypto

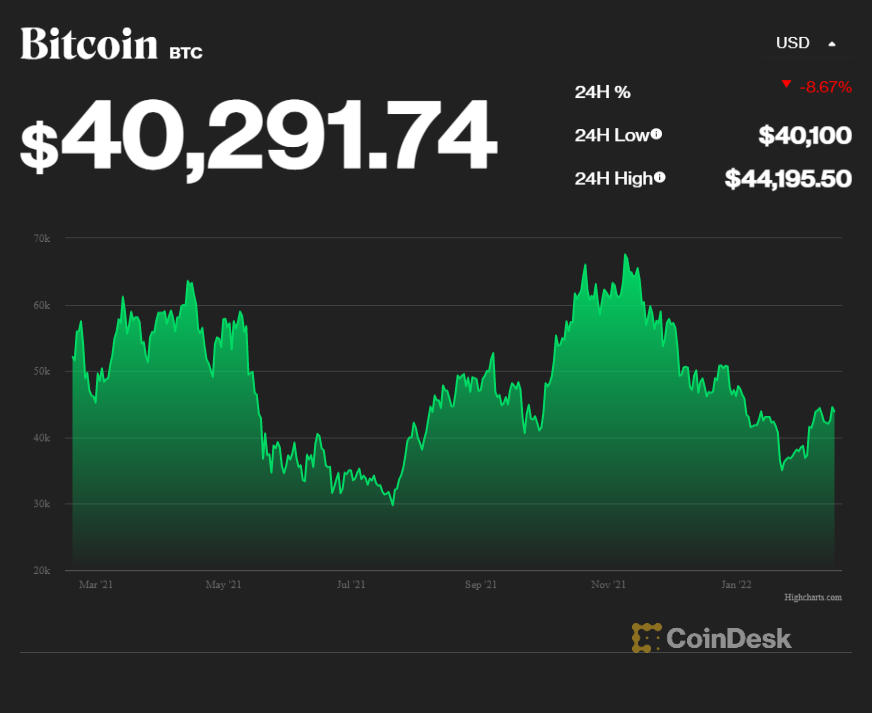

Crypto ETFs have been getting much attention lately, they have outperformed most other asset classes over the last five years. I do not like to talk about cryptocurrency as currency at all. At Deep Blue Financial we like to look at crypto as “crypto asset” more than a “crypto currency.”

I do not know if anyone can reliably tell you what the price of Bitcoin is going to be next month or next year, but I do not think anyone should ignore crypto assets. I would assume that soon financial advisors will be able to recommend allocating small portions of client portfolios to selected crypto “currencies.”

For a long time, financial advisors needed to shy away from recommending cryptocurrencies at all. They are not securities after all. They do not trade on any “authorized” exchange. Lately some exchanges have licensed crypto currency indexes such as ProShare’s BITO https://money.usnews.com/funds/etfs/trading-miscellaneous/proshares-bitcoin-strategy-etf/bito

Honestly, I do not understand why someone would be better off investing in a crypto ETF, vs just going out and buying a few heavily traded currencies like Ethereum, Tether, Lightcoin…heck even Dogecoin has a twenty billion market cap.

All this being said, this is how you should be investing:

Just invest your portfolio for the future. Your portfolio should be diversified. You should have stocks and bonds in your portfolio, and you should work with a professional to constantly assess how much risk is appropriate. If you want to invest a portion of your portfolio aggressively…that is fine, provided you can lose a substantial portion of your portfolio without risking your long-term happiness. In short…talk to your financial advisor. 😉